Cold winter ahead? Implications from a Russian gas cut-off for the euro area

Impairments to gas flows from Russia to Europe are currently widely discussed. A persistent lack of available gas could have severe impacts on households and firms. We quantify the impact of a sudden reduction in gas supply from Russia by considering current and past energy dependencies as well as the consequences from energy savings. We argue that a full cut-off from Russian gas would cause gas rationing in early-2023, triggering a recession in the euro area; the reduction in imports of energy from Russia has already helped to cushion consequences from rationing; energy savings as envisaged by the European Council can help to largely avoid further rationing in the winter, but only if overall gas consumption of households and firms can be reduced; and concerted action among EU members will help mitigate adverse effects of a cut-off of Russian gas.

As the war in Ukraine continues, gas flows from Russia have been partially reduced or even fully stopped in some European countries. The temporary closure of the Nord Stream 1 pipeline from Russia to Germany in early-July for maintenance exacerbated the risk of longer-term delivery impairment for the euro area. Two of the largest euro area economies, Germany, and Italy, remain the most vulnerable.

Gas inflows in the summer are mainly used to replenish reserves, crucial to cover the higher gas demand during the winter. Should gas demand exceed the sum of gas inflows from abroad and domestic gas production at a point in time when reserves have been exhausted, a rationing of gas will be unavoidable. In such a case, the EU has an action plan in place to prioritise household consumption (for electricity production, heating, or other necessary purposes).[1] This would imply a (partial or even full) shutdown of energy-intensive sectors’ production, adversely affecting employment and counteracting the post-pandemic rebound in labour markets.

Gas rationing would cause a recession in the euro area

To assess the possible growth impairment of gas rationing, we quantify the impact of a sudden reduction in gas supply from Russia. Based on a standard economic approach, our analysis shows that a full cut-off from Russian gas supply as of August 2022 would exhaust gas reserves by end-2022.[2] Some countries will be hit more severely than others, in particular Austria, Belgium, Germany, and Italy. Rationing of gas used by firms would therefore be required at the beginning of 2023, causing gas consumption in Germany, for example, to fall about 40% below the level expected without rationing.[3]

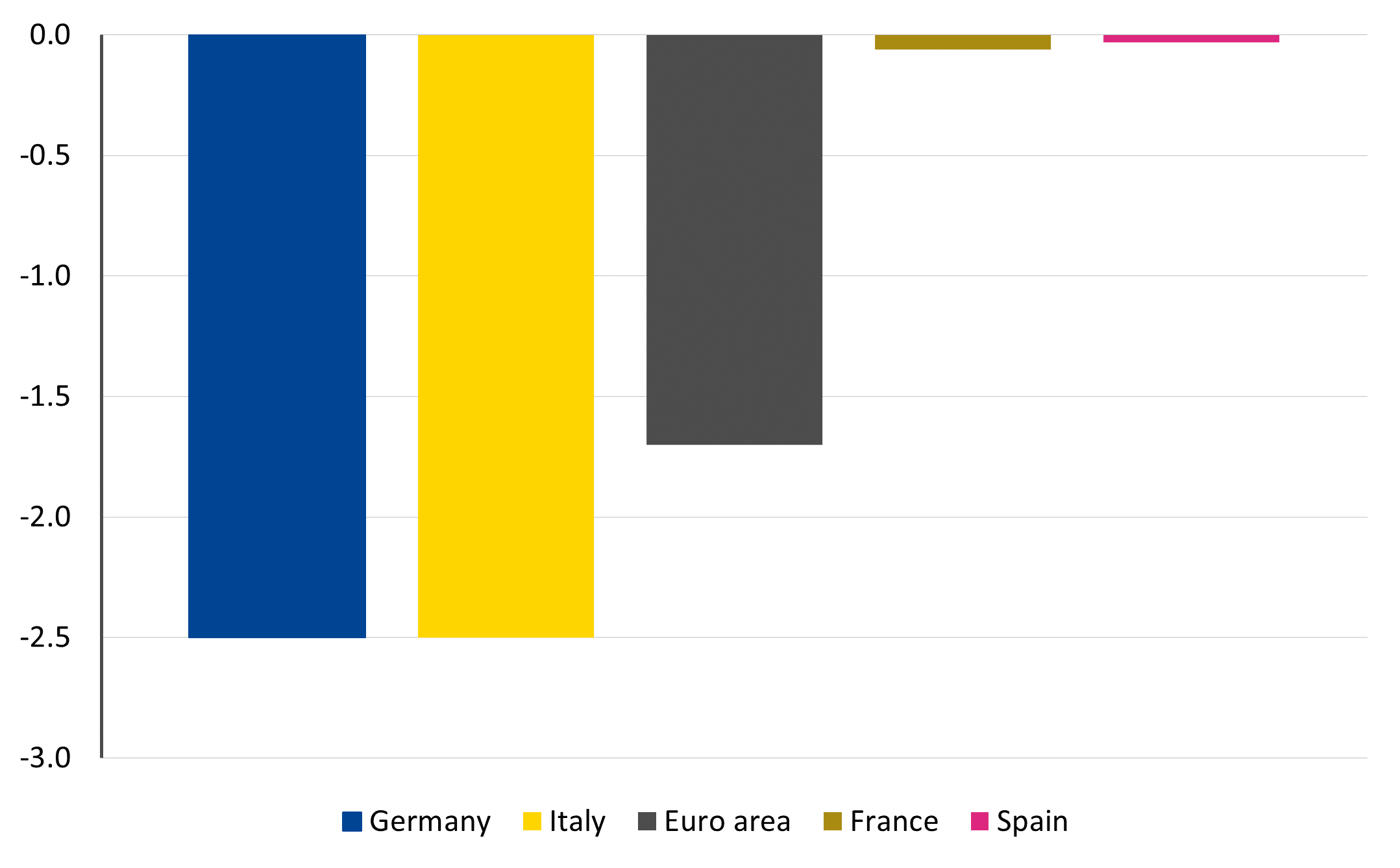

Energy intensive sectors would have to scale down production, thereby reducing euro area GDP by 1.7% below the benchmark case (reflecting no inflow constraints), eventually leading to higher unemployment.[4] [5] Two of the largest economies in the euro area would be hit strongly: GDP in Germany and Italy would fall by about 2.5% below benchmark in 2023. In some countries gas rationing is not expected to happen. However, these countries would nevertheless be adversely affected via trade relationships, like supply chains. France and Spain, for example, have a different energy mix and/or a lower reliance on Russian imports, so would be indirectly affected.

Figure 1: Output losses from rationing in 2023

(% change from no gas impairment case)

Notes: The figure shows the output losses of a Russian gas import stop and consequent rationing of gas by most energy-intensive sectors for the largest euro area economies and euro area aggregate. The output losses are shown as percentage deviation from a baseline with no gas impairment. The assumed Russian gas dependency is the one observed today.

Sources: ESM calculations based on OECD 2021 ICIO tables, Eurostat, European Network Transmission System Operators for Gas, and Aggregated Gas Storage Inventory (AGSI+).

Reduction in energy dependence from Russia made the euro area more resilient – but is not enough

Some countries have partially diverted their gas purchases to non-Russian sources. The euro area’s gas dependence on Russia has therefore fallen in the first months of 2022 compared with previous years. As less gas inflows are exposed to the cut-off risk, potential consequences have already been reduced by these efforts, although gas rationing might not be entirely avoided.

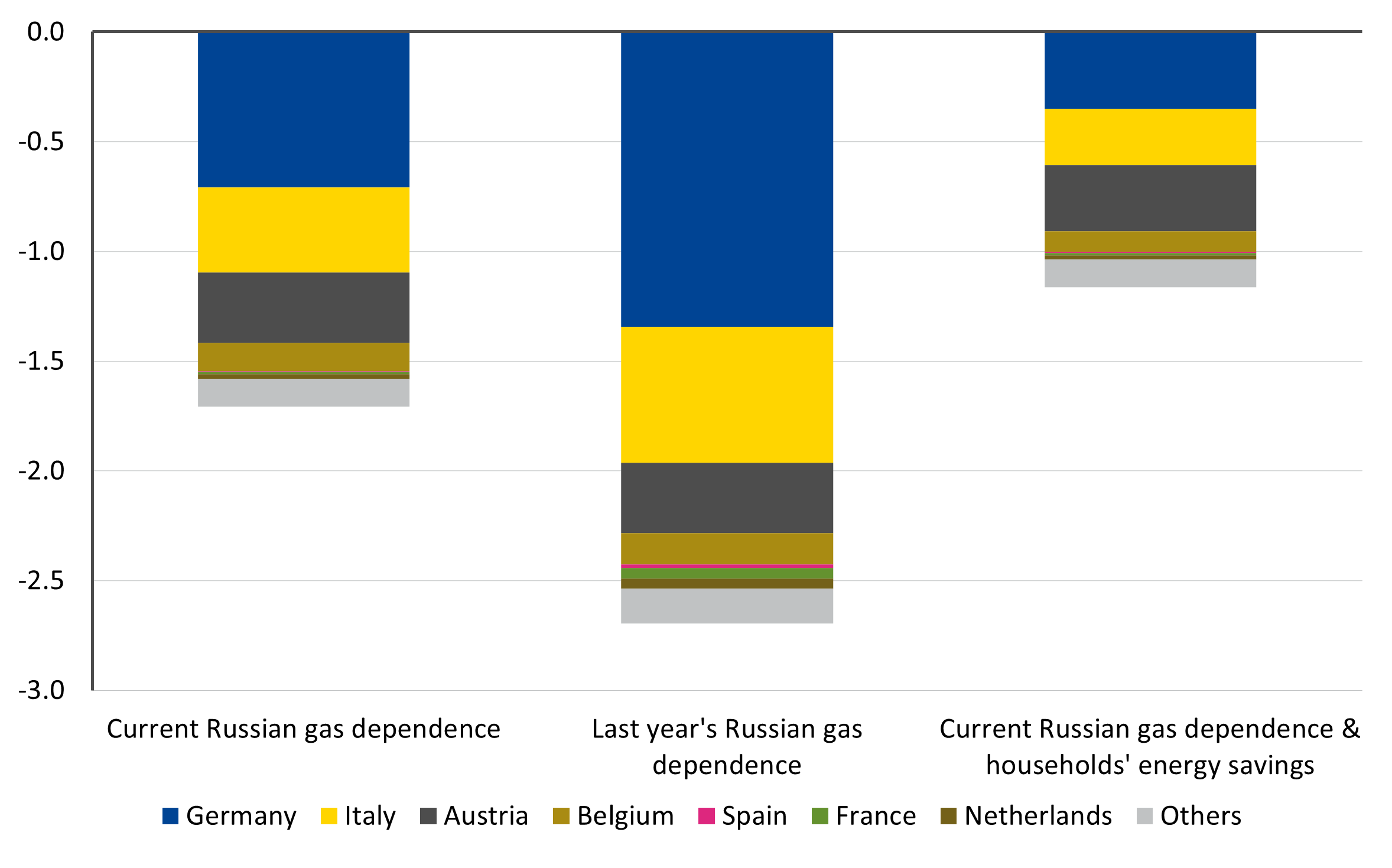

With last year’s degree of gas dependence, euro area GDP would fall by 2.6% below the case of no impairments, which is one percentage point more than with today’s degree of dependence on Russian gas. Gas rationing would be therefore more severe and would happen by up to two months earlier in Germany and Italy. Hence, the reduction in gas dependence from Russia has improved the euro area’s resilience by already saving future GDP losses in case of a gas import stop.

Economy-wide and union-wide energy savings can avoid rationing

The European Commission encourages countries to reduce gas demand by 15% between 1 August 2022 and 31 March 2023.[6] In the industrial sector, this could take the form of replacing gas with other energy sources where possible. For households and public administrations or owners of public buildings, this would mainly imply reducing gas use for heating purposes. A reduction in gas consumption could help to keep the energy intensive sectors operational as it implies a reallocation of available gas reserves. Rationing would become less severe, and firms would need to scale down their production by less, thereby stabilising employment.

According to our analysis, a persistent reduction of gas demand by 15% for households would dampen the fall in GDP – but rationing is not unavoidable in all countries.[7] In 2023, euro area GDP would be 1.1% below the case without inflow constraints. However, if total gas consumption (households and firms) can be reduced by 15%, gas rationing could be largely avoided without incurring large output losses.[8]

Figure 2: 2023 euro area output losses in three different scenarios

(% change from no gas impairment case and contribution in percentage points)

Notes: The figure shows the output losses of a Russian gas import stop and consequent rationing of gas by most energy-intensive sectors for euro area aggregate. The overall output losses are shown as percentage deviation from a baseline with no gas impairment. The euro area countries’ contributions are in percentage points. The far-right bar assumes households save 15% of their total gas consumption.

Sources: ESM calculations based on OECD 2021 ICIO tables, Eurostat, European Network Transmission System Operators for Gas, and Aggregated Gas Storage Inventory (AGSI+).

Adverse effects can be avoided with active energy policy and economic policy

A full gas import stop from Russia may well be very likely, making gas a scarce resource in the forthcoming winter. Consequently, either production will have to be scaled down, causing unemployment to rise, or persistent gas savings will be needed to help mitigate the impact on manufacturing industry once a gas import stop happens.

Effective use of Europe-wide gas reserves in solidarity among EU Member States could be another tool to cushion the blow from a gas shortage, leveraging on countries that have not exhausted their reserves to aid those in need.

Current energy policy measures will help moderate the adverse effects of a gas shut-off on economic activity by reducing the energy dependence on Russia. Economic policies can help mitigate the remaining impact and help cope with possible adverse effects. The EU Commission’s REPowerEU Plan describes concrete policy actions to reduce dependence on Russian energy and to cope with possible restraints.[9] Furthermore, country-specific measures are being taken to alleviate the impact of high energy prices on consumers. With joint efforts and targeted support policies, the euro area could avoid large employment losses, protect vulnerable groups, and maintain manageable public debt levels.

Acknowledgements

The authors would like to thank Niels Bünemann, Raquel Calero, Pilar Castrillo, Veronica Gottardo, Niels Hansen, and Rolf Strauch for valuable comments and contributions to this blog post.

Footnotes

About the ESM blog: The blog is a forum for the views of the European Stability Mechanism (ESM) staff and officials on economic, financial and policy issues of the day. The views expressed are those of the author(s) and do not necessarily represent the views of the ESM and its Board of Governors, Board of Directors or the Management Board.

Authors

Blog manager