Outside the box: ESM stepping up its game in ESG

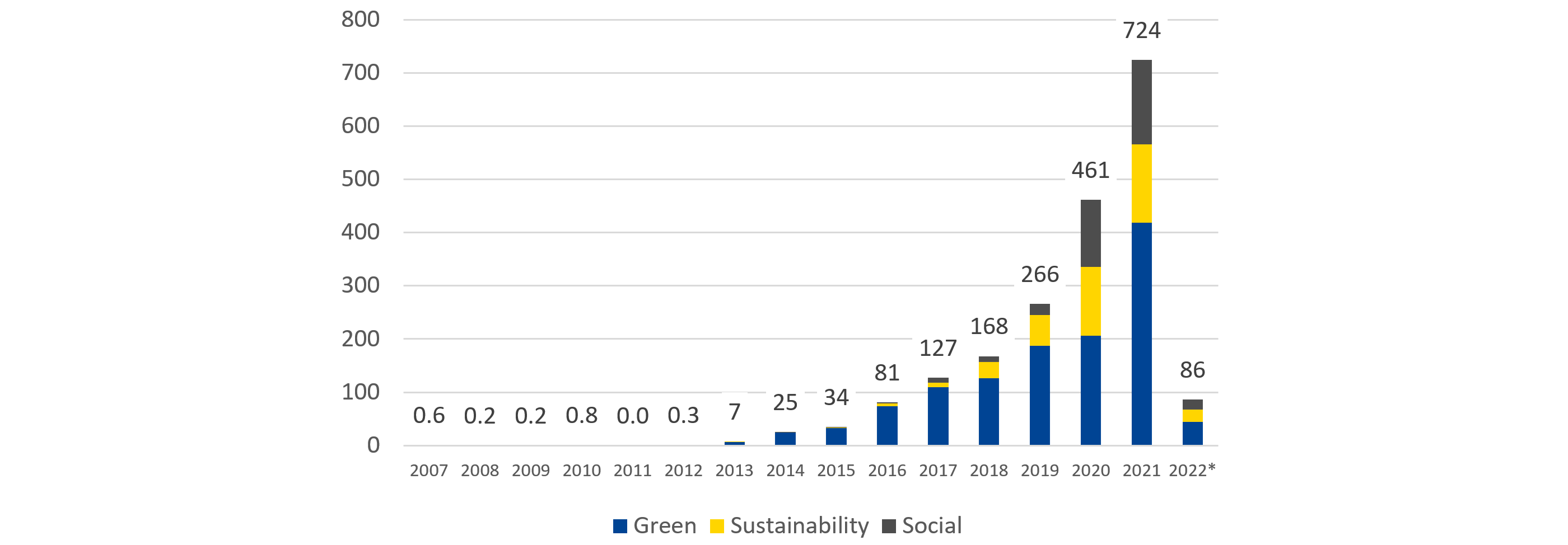

Environmental, Social, and Governance (ESG) asset volumes have flourished in recent years. By the end of 2021, ESG-themed bonds surpassed USD 2 trillion worldwide and could reach USD 3 trillion in the current year. ESG assets have attracted increased investor demand, with a trebling of issuance since 2018. Europe has led this growth in the bond market for 15 years, and for the right reasons. ESG initiatives are rooted in positive change and, as this blog post will argue, generate excellent investment returns too.

The ESM is also active in this substantial new asset class, as a significant ESG bond investor, a borrower with the means to issue social bonds, and a newly added observer at the Network of Central Banks and Supervisors for Greening the Financial System (NGFS).

The NGFS, born at the Paris “One Planet Summit” in December 2017, contributes to a better understanding of climate-related risks and supports green finance. This it does by helping strengthen the global response required to meet the goals of the Paris agreement, enhancing the role of the financial system to manage risks, and mobilising capital for green and low-carbon investments.[1]

How Europe came to lead the ESG debt market

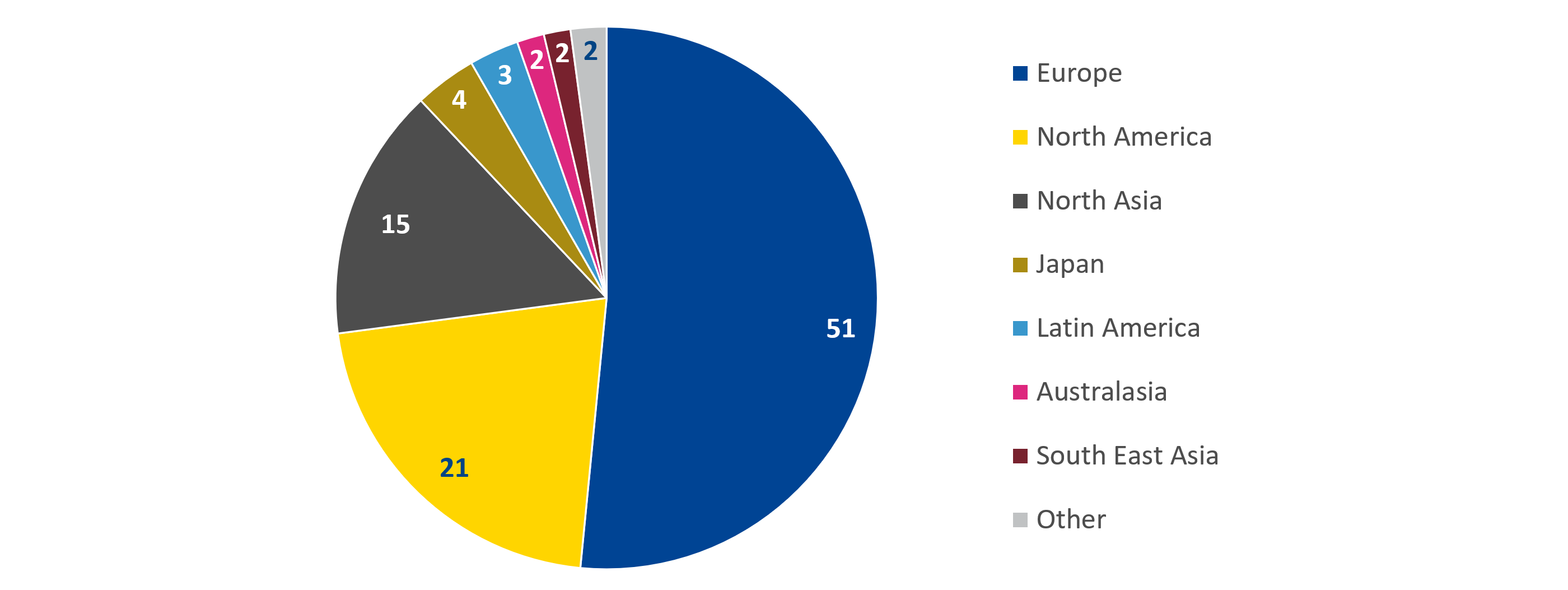

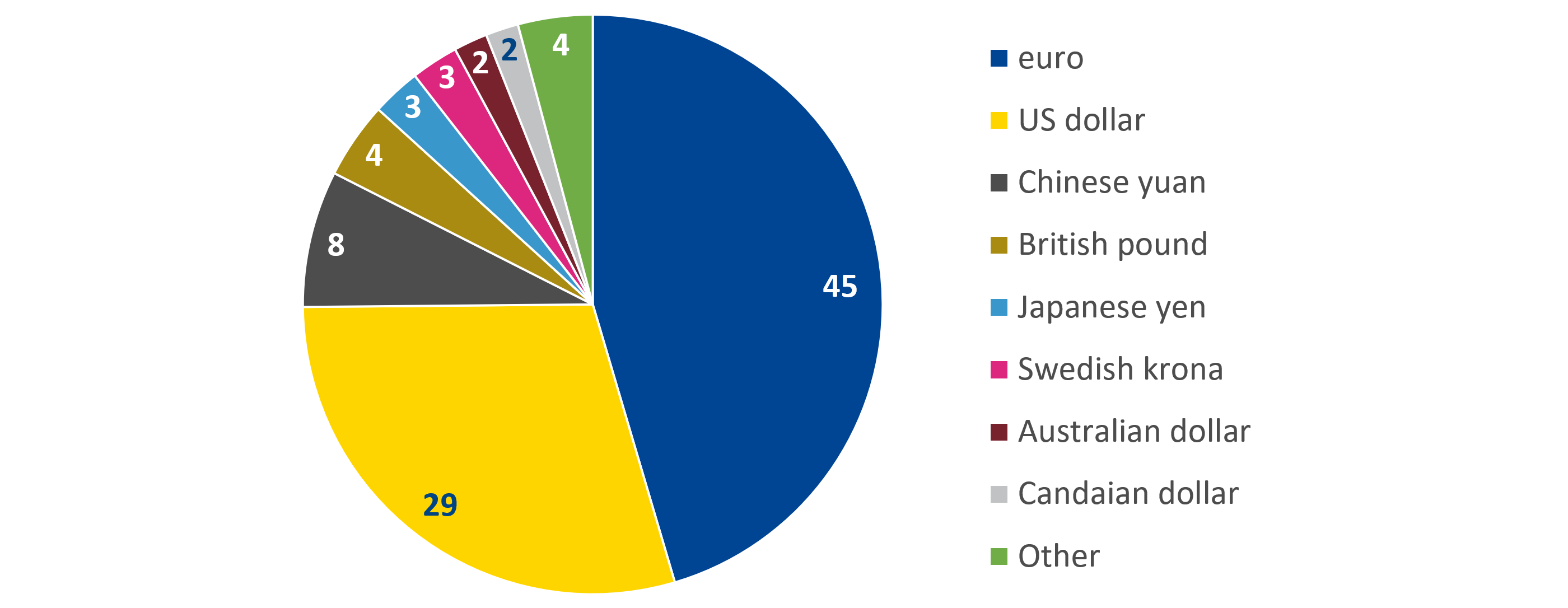

Europe is the global hub for sustainable bond finance. In 2021, around 51% of the issuers were from Europe (Figure 2) and 45% of the bonds were denominated in euro versus 29% for the US dollar (Figure 3).

But this did not happen overnight.

It took 13 years from the European Investment Bank green bond debut in 2007 for sustainable bond issuance to reach USD 1 trillion equivalent, but just 11 months to double again in 2021.

Contributing to that rise was a spike in use-of-proceeds bond issuance resulting from the EU’s first pandemic policy response in 2020. Both the European Commission and the ESM established social bond frameworks to finance expenditure incurred from the pandemic. The ESM’s Pandemic Crisis Support, whose proceeds can help euro area member states fund their pandemic-related healthcare costs and would be principally funded by social bonds, is a credit line introduced in 2020 that remains available for applications until the end of December 2022.

Later the EU’s second line of response committed 37% of the €750 billion Next Generation EU (NGEU) package to green bond issuance.[2] That was in addition to the near €100 billion in social bonds raised for the European Commission’s Support to mitigate Unemployment Risks in an Emergency (SURE) job protection programme.

Where there is supply there must be demand. The October 2021 inaugural green bond of €12 billion, part of NGEU, took the title of the world’s biggest such bond when it gathered investor interest of more than €125 billion, outstripping the supply ten-fold. Euro area sovereigns also helped raise the supply of ESG bonds in 2021, with Spain, Italy, Latvia, and Slovenia issuing bonds, and Greece set to follow later this year.

This leadership in ESG is crowned by the EU’s sustainable finance taxonomy, which sets the foundation for “gold standard” frameworks for global investors in green finance such as the EU Green Bond Standard (EUGBS).

Figure 1: Record growth of ESG bond market

(in Eur billion)

Note: Data up to 21 February 2022.

Source: Dealogic and ESM calculations

Figure 2: Breakdown of ESG bond issuance, by region

(in %)

Note: Shares calculated for total ESG bond issuance between January 2007 and February 2022.

Source: Dealogic and ESM calculations

Figure 3: Breakdown of ESG bond issuance, by currency

(in %)

Note: Shares calculated for total ESG bond issuance between 1 January 2007 and 21 February 2022.

Source: Dealogic and ESM calculations

As our 2020 annual report recorded, the ESM has heavily increased its investments in ESG use-of-proceeds bonds. In 2018 they amounted to €475 million, by 2020 they represented €4.5 billion – a near ten-fold increase compared with an investor average of under three times over the same period.

Benefits of ESG initiatives

While the purpose of use-of-proceeds bonds is to support the underlying ESG projects, these assets can also generate positive incentives for investors. For example, Germany issued a twin government bond in September 2020: a conventional bond and a green bond with identical coupon and maturity. At issuance, investors accepted a one basis point lower return for the green bond versus the conventional bond, to support green efforts. One year later, the green bond strongly outperformed the conventional bond in the secondary market. By September 2021, it traded seven basis points lower. As yields and bond prices are inversely related, it means that the green bond’s price rose. This difference in yield is often referred to as a “greenium”.

Figure 4: German August 2030 Green Bund one-year performance

Source: Federal Republic of Germany (September 2021)

As an institution, the ESM also practices what it preaches. We measure and report the carbon footprint arising from our day-to-day operations and, through this, have been able to design and implement appropriate reduction measures. In line with these efforts, the ESM endeavours to incorporate ESG considerations when reviewing internal policies, procedures, and business projects. These efforts are aligned with the ESM’s robust governance structure coordinated by the ESG working group and a strategic steering group. You can discover more about our ESG activities here.

What’s next?

The upcoming EUGBS is among the topics to watch in 2022. The EUGBS is a voluntary standard to help scale up and raise the environmental ambitions of the green bond market in line with the EU Taxonomy.[3]

Another exciting prospect for Europe this year could be the introduction by France of the world’s first inflation-linked green bond,[4] while Belgium, Germany, Austria, and Greece are expected to add green bond supply in 2022.[5]

Looking ahead, we want to do even more to further ESG initiatives. That is why our executive team has agreed to integrate ESG and climate change issues into all our activities.

As part of this strategic objective, we are increasingly taking climate risks into account in our financial and economic analyses and will continue to integrate ESG criteria into ESM investment practices - on top of the ESM’s already ongoing ESG commitments - reinforced by our admission to the NGFS. In addition, we will continue interacting with rating agencies and ESG data providers on such matters. Furthermore, we are interested in collaborating with other bodies to steer sustainability topics. You will hear more from us in the coming months on this evolving theme.

The world – led by Europe – is stepping up its game in ESG. So is the ESM.

Acknowledgements

The author would like to thank Amaia Garces de los Fayos Alonso, Niyat Habtemariam, Rana Jalilova, Maria Kartcheva, Jürgen Klaus, Peter Lindmark, Eduardo Maqui, Carlos Martins, George Matlock, Fernando Rodriguez, Ioannis Vazouras, and Silke Weiss for valuable comments and contributions to this blog post.

Further reading

Europe greening the world: the “Brussels effect” on sustainable finance

Footnotes

About the ESM blog: The blog is a forum for the views of the European Stability Mechanism (ESM) staff and officials on economic, financial and policy issues of the day. The views expressed are those of the author(s) and do not necessarily represent the views of the ESM and its Board of Governors, Board of Directors or the Management Board.

Author