Euronomics: The current terms of trade shock and the loss of wealth – are we heading back to the 1970s?

The Russian invasion of Ukraine is undoubtedly a humanitarian and geopolitical tragedy – but it is also stifling economic recovery from the pandemic and renewing underlying uncertainties. Households and companies are facing supply-chain constraints and price inflation. The rise in energy prices and in a broad range of products has reached an unprecedented pace not seen before in Economic and Monetary Union, raising questions about how families and firms can address these costs. In this column, I describe the economic impact of this deterioration on terms of trade and compare it to past episodes. Today, the euro area economy seems more resilient to changes in energy prices. For energy-importing countries, the increase in energy prices is a transfer of income and wealth abroad. While the wealth transfer entailed in global price changes cannot be avoided, targeted fiscal support can help cushion the blow to vulnerable households. Governments can help by pushing the energy transition forward and reducing energy import dependencies and diversifying energy sources.

The current increase in oil, gas, grain, and metal prices translates to major changes in terms of trade for countries around the world.[1] Over the past year, the price of energy and other commodities the euro area imports has increased faster than the price of its exports, disadvantaging its economy. The rebound of global demand following the pandemic crisis initially drove this change. While euro area economies suffered from the higher costs of imports, higher demands for its products partially balanced this out. This does not hold for the war in Ukraine. Renewed supply shortages emerging from the war drive up prices of goods exported by Ukraine and Russia, such as energy, food, and metals.

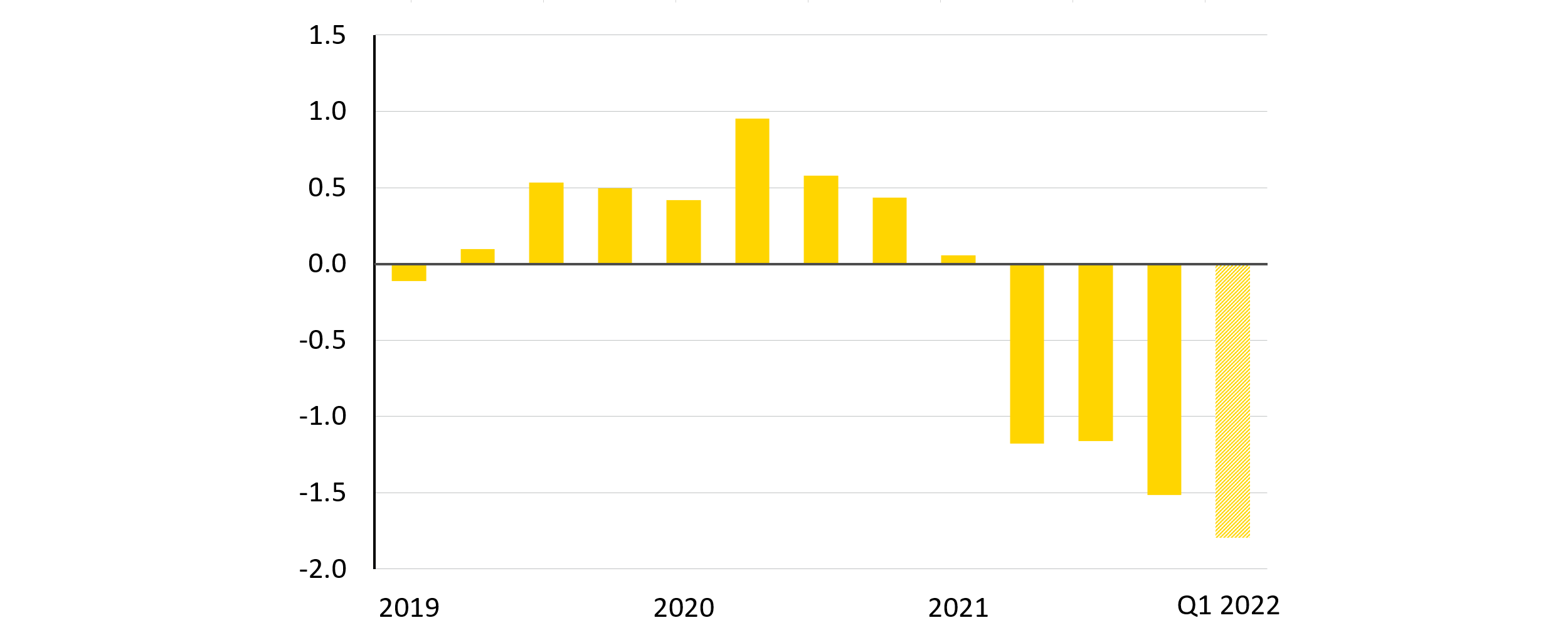

Real income loss – from deteriorating terms of trade – has now reached magnitudes comparable with the big oil price shock of the 1970s. For euro area countries, the loss of real income due to the deterioration of terms of trade was 1.3% of GDP in 1974. This was the biggest energy price shock in post-World War II history. The income drain was 0.8% during the second oil crisis in 1980 and 1981.[2] For the last quarter of 2021, the real income loss amounted to 1.5% of GDP, and provisional ESM estimates suggest that this loss will even increase further this quarter due to the continued energy price hike (see Figure 1).

Figure 1: Income effects of terms of trade in the euro area

(in percent of GDP)

Notes: Data follows AMECO definition of "APTA" series and refers to the four-quarter change in nominal exports divided by the import deflator minus real exports. The four-quarter change is divided by the four-quarter lagged real GDP. Trade data refers to goods and services trade. Latest actual datapoint is Q4 2021. The datapoint for Q1 2022 is estimated based on an AR-1 model with average quarterly oil prices, available as of 23 March 2022, as contemporaneous explanatory variable.

Sources: ESM calculations, Eurostat, and Financial Times.

The terms of trade deterioration will add to inflationary pressures in the euro area and put a dent on growth.[3] Initially, the inflationary pressure will hinge on how commodity prices affect the cost of living, which may only be fully apparent in a year. Later, the inflationary effect will depend on how it affects wage- and price-setting.[4] Current estimates about the impact on inflation and growth vary widely. Markets estimate that inflation may be two percentage points higher this year due to the impact of the war, and economic growth one percentage point lower.[5] Recent sentiment indicators point to a loss of confidence, which could even worsen the impact substantially. A combination of higher prices and low growth, commonly known as “stagflation”, is worrisome. The precise impact differs across euro area countries, depending on each country’s energy dependency, trade structure and other factors.

While there are fears that the euro area may end up in an extended stagflationary period akin to that of the 1970s and 1980s, several arguments point to the region’s higher resilience to energy price shocks, making the impact less persistent than in the past. Though, one has to be mindful that the further course of the war is unknown and that medium- to long-term repercussions are uncertain.

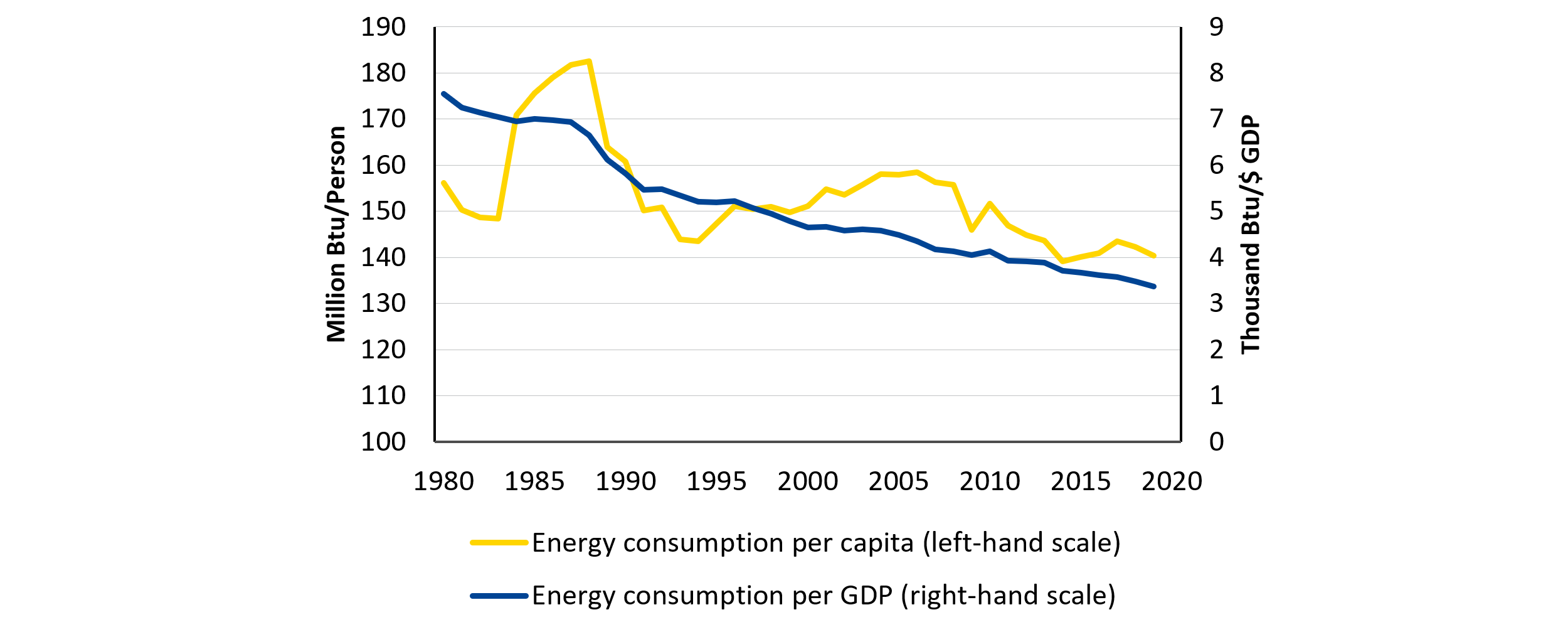

First, lower energy dependency has made the euro area economies less vulnerable to energy price hikes.[6] Indeed, energy consumption per capita has been declining over the past decades. Similarly, the energy intensity – i.e., energy used to produce a given level of output – has decreased, weakening the impact of fuel price hikes (see Figure 2).

Figure 2: Energy consumption in the EU

(per capita and per output)

Notes: Btu stands for British thermal unit. Output is purchasing power parity (PPP) adjusted. Latest datapoint refers to 2019.

Source: Energy Information Administration

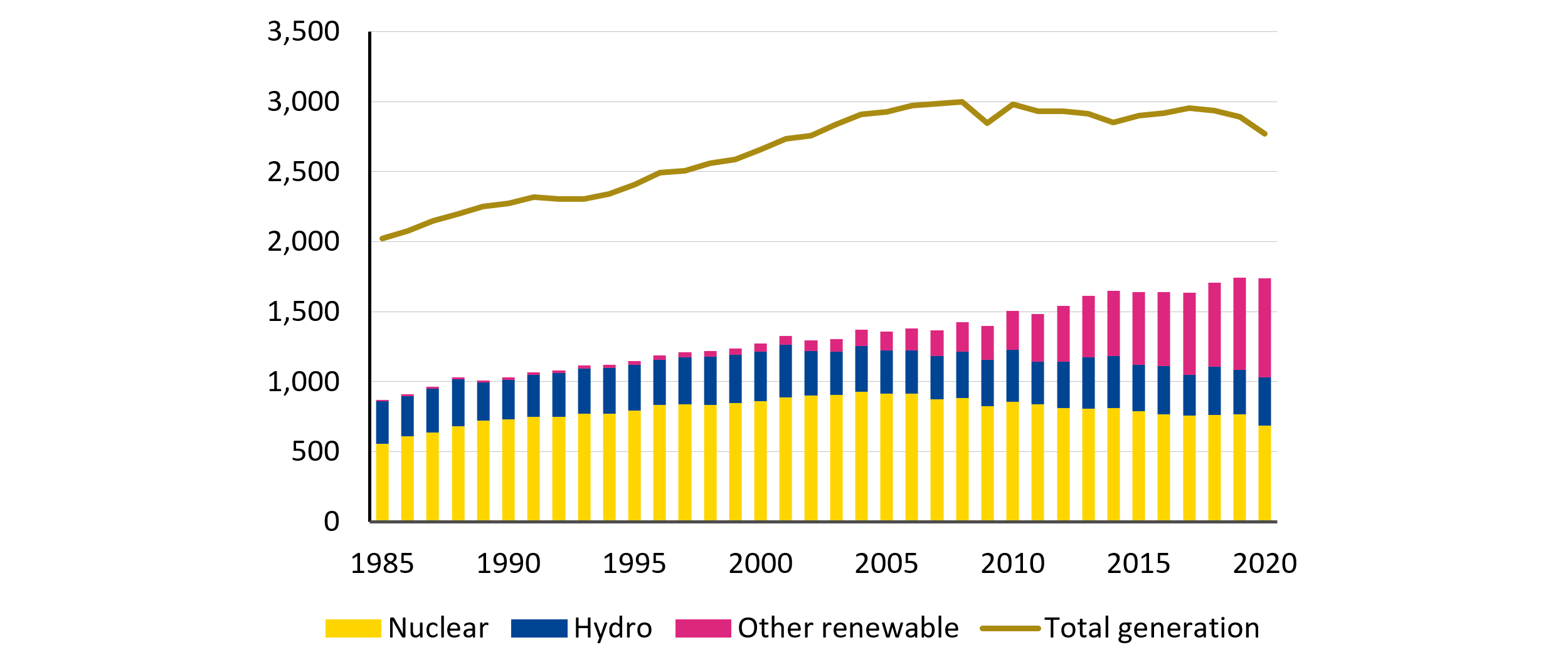

Also, the share of energy in European countries’ foreign trade has declined overall. This has a lot to do with the energy mix within euro area member states, which have increased their production of nuclear and renewable energy (see Figure 3). Evidently, there are substantive differences in the specific structure of the energy sector across countries. While this helps to mitigate the impact of the energy price hike, one has to be mindful that some countries, like Germany and Italy, remain particularly vulnerable to gas and oil imports from Russia, and the current commodity price shock is not confined to energy, but also includes grains and metals.

Figure 3: Electricity generation in the EU

(in terawatt-hours)

Source: British Petroleum

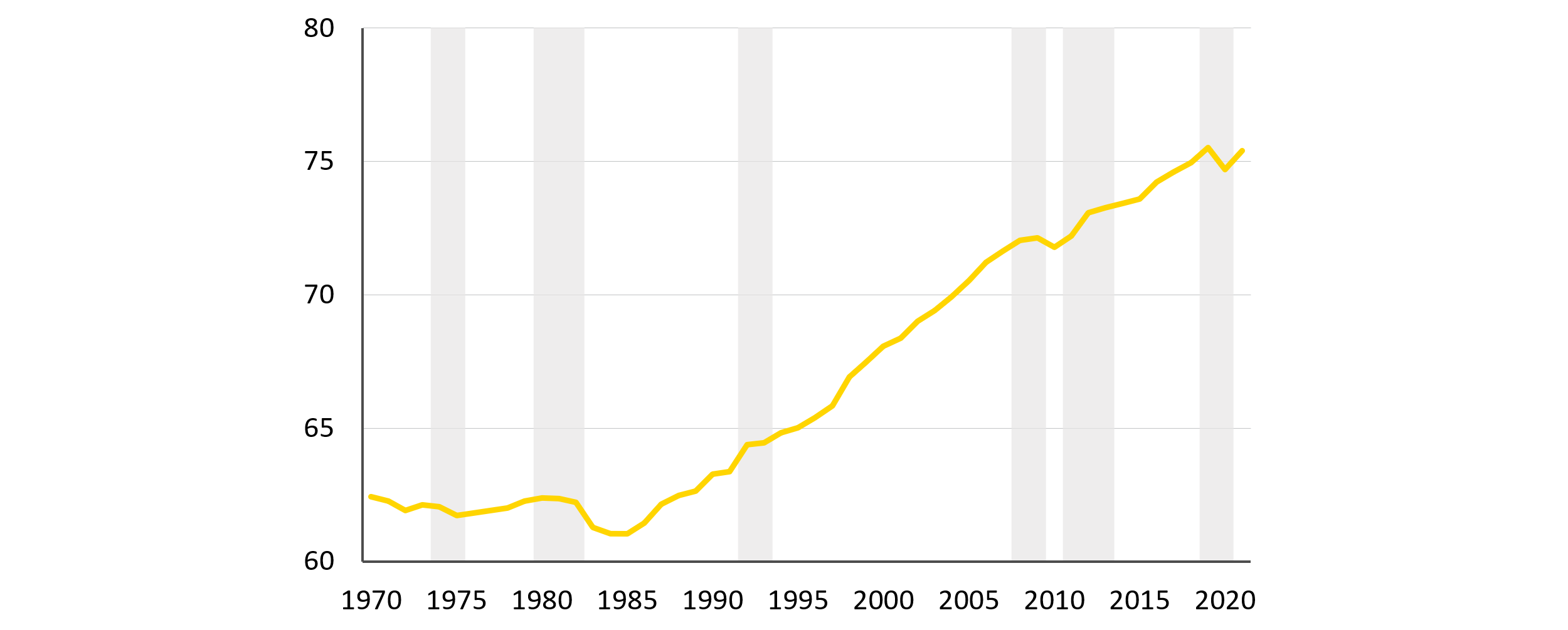

Second, labour markets function differently than in the past and generate less persistent inflationary pressures. Today, labour unions are less powerful than in the 1970s as they rally a lower percentage of workers behind them. Moreover, most euro area economies abandoned automatic wage indexation linking wages to inflation. While this reduces the persistence of inflationary pressures, it also may lead to a loss in real disposable income. It is equally important that because of past reforms and higher female participation in the labour force, the participation rate is higher than in the past. Higher participation rates support income and growth. In earlier crises, especially after the second oil price shock, many workers would retire early or otherwise drop out of the labour market entirely (see Figure 4).

Figure 4: Labour force participation rate in euro area with the 12 member countries until 2021

(15-64 years)

Note: Grey bars refer to Centre for Economic Policy Research recession definition. Euro area 12 includes: Austria (AT), Belgium (BE), Finland (FI), France (FR), Germany (DE), Ireland (IE), Italy (IT), Luxembourg (LU), Netherlands (NL), Portugal (PT), Spain (ES), Greece (EL).

Source: European Commission (AMECO database), Centre for Economic Policy Research

Third, the European Central Bank can build on its strong reputation, as inflation expectations have remained aligned with the objective of price stability over the medium-term. Once inflation expectations become de-anchored (i.e., consumers and businesses do not believe the central bank will meet its price stability objective), tighter than expected monetary policy may be required to re-anchor them. This is more costly for growth, as higher interest rates push up the cost of borrowing and weaken consumption and investment. That was the experience of the US after the second oil price crisis in the 1980s, when the Fed aggressively tightened its monetary policy under Chairman Paul Volcker to recover credibility.[7] Currently, euro area inflation expectations in surveys and in financial markets are still close to the European Central Bank’s inflation of 2% over the medium-term, which has clearly expressed its determination to act in this uncertain environment to effectively prevent de-anchoring.

Deteriorating terms of trade lead to a loss of income and wealth, but the euro area economy is overall more resilient to weather commodity price hikes than in the past. In the short run, little can be done to avoid or correct the loss of wealth. The increases in energy and food prices will affect the poorest most, as they consume a large part of their earnings. Governments can aim to cushion the impact for the most vulnerable with targeted policies. For firms, the need for policy support depends on how energy-intensive the sector is and on whether access to finance from banks and in markets remains possible. From a medium-to long-term perspective, a rapid and effective deployment of the Next Generation EU fund in Europe seems increasingly vital. Enforcing the green transformation and strengthening energy diversity was already a key objective for the future, but a crisis has made the urgency to act more acute.

Acknowledgments

This column builds on work by Gergely Hudecz, Martin Iseringhausen, and Edmund Moshammer. I would like to thank my colleagues for their valuable contribution.

About the ESM blog: The blog is a forum for the views of the European Stability Mechanism (ESM) staff and officials on economic, financial and policy issues of the day. The views expressed are those of the author(s) and do not necessarily represent the views of the ESM and its Board of Governors, Board of Directors or the Management Board.

Author

Blog manager